Poliquin Introduces Bill to Help Parents and Students Save for College

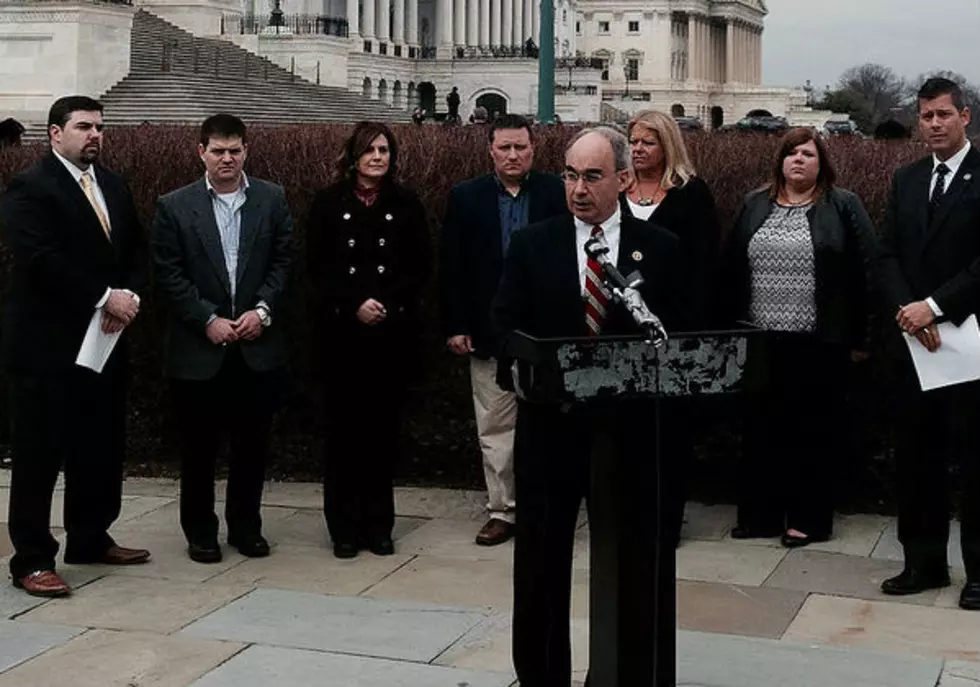

Maine’s 2nd District Congressman, Bruce Poliquin, announced Monday his new bill that will provide parents and students additional options to save for college by improving 529 college savings plans.

The Help All Americans Save for College Act of 2016 will revise 529 college saving plans to operate more similarly to the 401(k) retirement savings accounts so many people use. It will make these significant changes: 1) allow employees to deduct up to $5,000 per dependent from their federal taxes for money deposited into a 529 account, 2) allow employers to match contributions tax-free while giving them the flexibility to choose their contributions of up to $5,000 per employee dependent, and 3) change 529’s into tax benefits, incentivizing businesses to provide workers access to human resource services that can help explain any complexities.

In essence, among other changes, Congressman Poliquin’s bill will help make college tuition for kids another employee benefit that job creators can use to attract and retain employees, by matching their contributions toward their kid’s education.

“College tuition costs are higher now than ever,” said Congressman Poliquin. “When I was entering college, students were able to work a job during the summer and take on only a modest amount of debt, if any, to finance their education. Today, students are incurring insurmountable debt and, as a result, are often discouraged from pursuing the schools and careers of their choice.

This information was submitted to us as part of a press release. If you would like to share your community news or event with our audience, please email newspi@townsquaremedia.com

More From